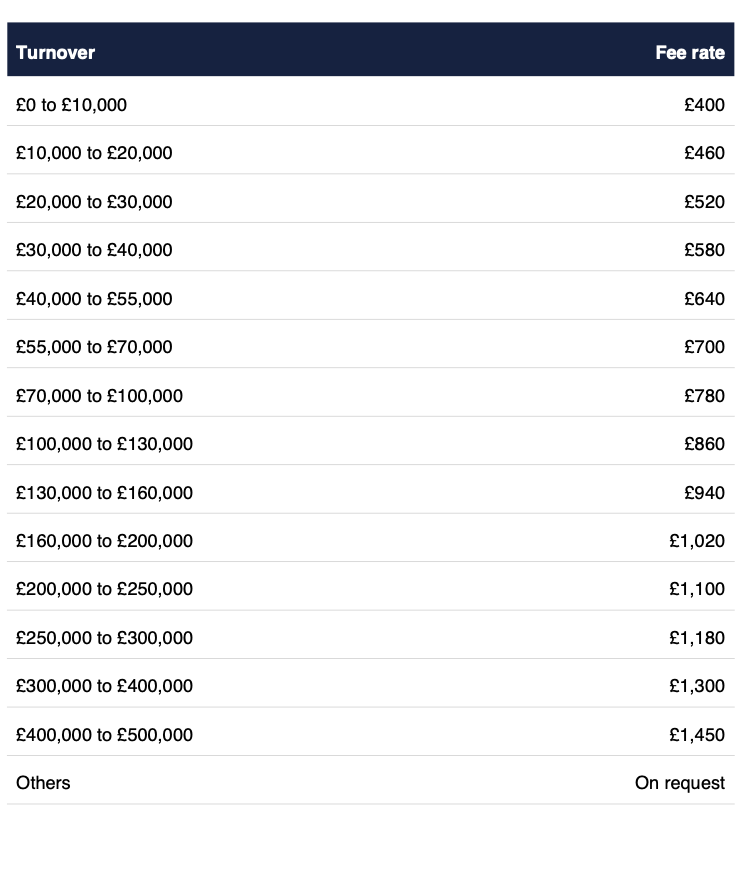

Company Accounts and Corporation Tax Return Fees

This service includes the preparation and filing of the Company’s accounts with Companies House as well as the Corporation Tax return with HMRC. We will also look at options to improve tax efficiency. Turnover refers to the net figure shown in the accounts and excludes VAT.

Fees do not include the filing of the Confirmation Statement. As this is a straightforward process, we encourage clients to complete it themselves; however, we can file it on your behalf for an additional fee of £100 plus the Companies House filing fee.

Occasionally a company may have an accounting period over 12 months. As HMRC only accept Corporation Tax returns for up to 12 months, a second CT600 is required. In these cases, an additional £100 will apply.

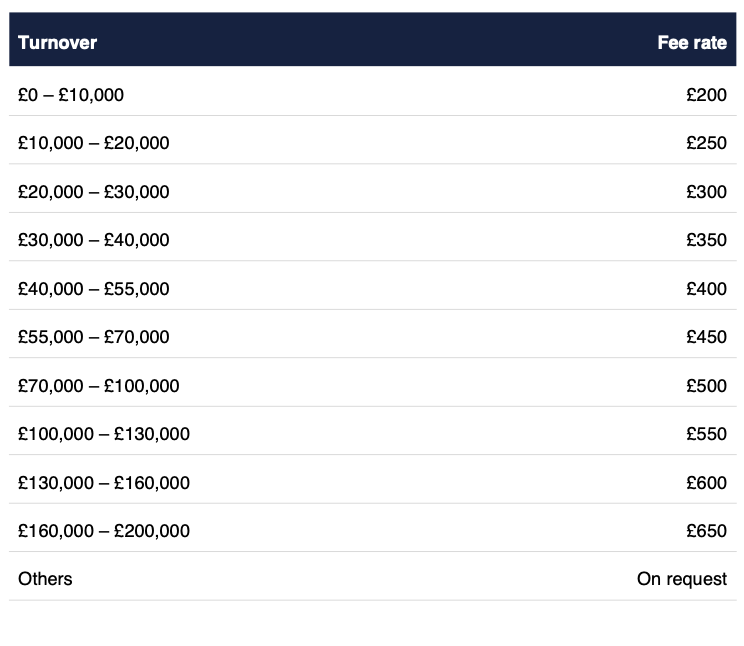

Individual Self Assessment Tax Return Fees

This fee applies to a basic tax return including PAYE income, dividends, interest, and/or pension income only.

Capital gains, foreign income, multiple employments, and other complexities are charged separately.

Separate additional fees will be charged for business accounts or property rental income calculations if required.

Sole Trader / Partnership Accounts (Self-Assessment)

Fees include the preparation of annual accounts for Self Assessment purposes.

If you operate as a sole trader or partnership, you will need to prepare annual accounts in order to complete your Self Assessment tax return.

Our fee schedule reflects the additional work involved as a business grows.

For example, the total fee for a sole trader with an annual turnover between £30,000 and £40,000 would be:

• £350 for the preparation of accounts

• £199 for the Self Assessment tax return

This gives a total cost of £549 to cover all year-end compliance and filings.

For partnerships, the above fees relate to the preparation of partnership accounts. Partnership tax returns and partners’ individual Self Assessment returns are charged separately.

For partnerships, HMRC requires an additional partnership tax return to be submitted alongside the individual Self Assessment tax returns for each partner.We therefore charge a £300 fee for the partnership tax return, in addition to the business accounting fee and the cost of the individual partners’ Self Assessment tax returns (as outlined above).

This fee assumes a straightforward partnership with clean records. Additional complexity or queries may be charged separately.

Partnerships

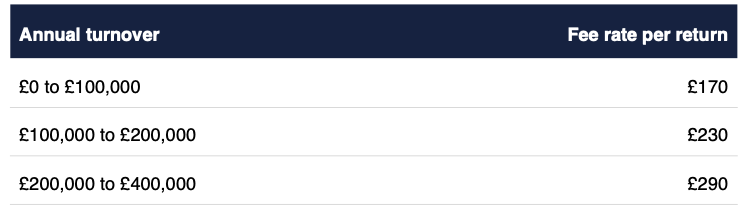

Fees for rental properties are charged annually on a per-property basis and apply to each property included on a tax return. These fees are in addition to the standard £199 Self Assessment tax return fee.

Where a property is jointly owned, the rental property fee is charged once per property, not per owner.

Example

A husband and wife jointly own two rental properties and both require Self Assessment tax returns.

Fees:

• 2 rental properties × £100 = £200

• 2 Self Assessment tax returns × £199 = £398

Total fees: £598

Rental Property Income (Self-Assessment)

Cloud Accounting Services

We offer cloud accounting services tailored to your business needs. Due to the wide range of options available, we do not operate a fixed menu of cloud accounting services and prices.

We can either review your own bookkeeping on a monthly or quarterly basis, or manage all bookkeeping on your behalf. Our packages can include software subscriptions, such as QuickBooks or Xero, which may help reduce overall costs.

Initial setup work may involve additional hourly charges. We will provide a clear estimate and keep you informed if the level of work changes.

Record Keeping

We aim to keep our fees competitive compared with other Chartered Accountants. To help us do this, we ask that accounting records are kept up to date and that information provided to us is accurate and submitted in a timely manner.

If records are incomplete or require additional work to bring them up to date, we may need to carry out some extra bookkeeping. Where this is the case, we will discuss any additional fees with you in advance.

This applies across all services listed on our website.

Making Tax Digital (MTD)

VAT returns are prepared and submitted in accordance with Making Tax Digital (MTD) requirements and assume the use of compatible accounting software. Set-up, software support, data migration, and bookkeeping corrections are not included unless agreed separately.

Making Tax Digital for Income Tax (MTD IT) will introduce additional reporting and submission requirements in future. These are outside the scope of current Self Assessment services and will be priced separately when applicable.

Other work

Occasionally we are approached to do work which is outside of the normal fixed fee schedule items. A fixed fee for this type of work can normally be provided on request. If that is not possible we may be able to consider charging at an hourly rate.

Incomplete work

We may be approached to take on work at a fixed fee which is started but not completed due to changes in client circumstances. In such cases, we may invoice part of the agreed fixed fee based on the level of completion of the work.

Invoicing and Payment Terms

When we prepare year-end accounts, self assessment returns or quarterly VAT returns, we normally issue our invoice at the point when draft figures are provided.

We then complete a review process, identify any potential issues, and obtain your approval that the figures are ready for submission.

Once approval has been given and the figures are finalised, we request payment prior to submitting the returns. Submission is normally made on the same day or the following working day, and we will provide confirmation once the submission has been successfully accepted.